How To Track Your Expenses Effectively? Tools And Tips

Are you finding it challenging to keep your finances in check? Tracking expenses is a key enabler toward financial stability and peace of mind. From monitoring where your money goes, you can derive essential insights into how you spend your money and make informed decisions concerning your financial future. Effective expense tracking lets you recognize where to cut back, save more, and make headway toward your financial goals. Take control of the often-daunting task of expense management by arming yourself with the proper tools and strategies.

Tracking Your Expenses Is Important

Keeping track of your expenses is crucial to financial stability and reaching your monetary goals. By closely examining where your money goes, you will gain insight into your spending habits and can make informed decisions about your finances.

Financial Literacy

When you track your expenses, you become financially aware. You start noticing spending patterns, where you overspend, and where you could cut back. This is the foundation for making positive changes in your financial life.

Budgeting Made Easy

Expense tracking makes budgeting easy. You can create realistic budgets that reflect your expenses and income by clearly showing your spending habits. This makes sticking to financial plans easy and prevents overspending.

Goal Setting And Achievement

Knowing where your money goes is the foundation of setting and achieving financial goals. Whether you are saving for a down payment on a house, planning a vacation, or building an emergency fund, tracking your expenses helps you to allocate your resources effectively and stay on track.

Reduced Financial Stress

Keeping track of your finances will help reduce anxiety and Stress related to money matters. You will be better positioned to control your finances, leading to better well-being and peace of mind.

Essential Expense Tracking Tools And Apps

Now, in this digital era, many tools and apps can be used to make tracking expenses more manageable. Such technological solutions offer convenience, accuracy, and insights that manual methods often lack.

Mobile Apps For On-The-Go Tracking

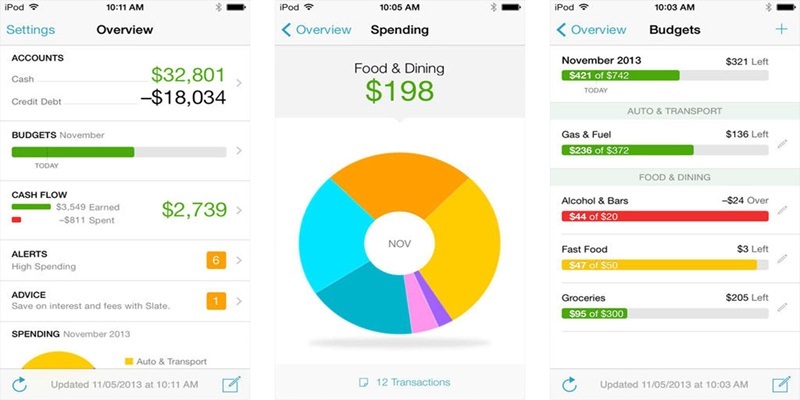

Some smartphone apps, such as Mint, YNAB (You Need A Budget), and Personal Capital, allow you to log expenses instantly. Most apps link with your bank accounts and credit cards, automatically categorizing transactions. Many offer features like receipt scanning and budget alerts, making it easier to stay on top of your spending habits wherever you are.

Desktop Application For In-Depth Analysis

Desktop software like Quicken or GnuCash offers robust expense tracking for those wanting to track expenses in more detail. These programs provide in-depth reporting and investment tracking and often have built-in features for tax preparation and business expense management.

Spreadsheet Templates For Customization

Spreadsheet enthusiasts can leverage pre-made templates in Excel or Google Sheets, which allow customization to fit the user's specific expense categories and formulas. These templates require more hands-on input but offer complete control over your financial data and can be tailored for special budgeting purposes.

Simple Tips For Efficient Expense Tracking

You can only master your finances if you know where your money goes. Here are some painless ways of tracking your expenses.

Keep a Daily Log

First, write down every purchase you make, no matter how small. This habit will help you become aware of your spending patterns. Use a notebook, smartphone app, or spreadsheet to jot down each expense as it happens. Include the date, amount, and category for each entry.

Categorize Your Spending

Organize your expenses into categories, such as housing, transportation, food, and entertainment. This breakdown helps you identify areas where you might be overspending. Be specific with your categories to get a more accurate picture of your financial habits.

Review And Analyze Regularly

Set aside time each week to review your expense log. Look for trends and patterns in your spending. Are there any surprises? Are there areas where you're consistently going over budget? This regular check-in helps you stay on top of your finances and adjust as needed.

Leverage Technology

Take advantage of expense-tracking apps and software. Many tools will automatically categorize your spending, sync with your bank accounts, and generate helpful reports. Some popular options include Mint, YNAB (You Need A Budget), and Personal Capital. Choose one that fits your needs and lifestyle.

Categorizing And Analyzing Your Spending

Categorizing and analyzing your expenses is the next step to performing effective expense tracking. When you categorize your spending into different buckets, you will have a clear idea of your financial habits; then, you can observe where improvements can be made.

Create Meaningful Categories

First, create clear, relevant categories for your expenses. Common categories include housing, transportation, food, utilities, entertainment, and savings. Tailor these categories to your lifestyle to ensure they accurately reflect your spending patterns.

Analyze Spending Patterns

Now that you have grouped your expenses, drill down further into the data. Look for trends and patterns in spending money: Are you spending too much on discretionary expenses? Does the cost of housing consume too large a portion of income? This analysis will allow you to identify areas where you can cut spending or reallocate to meet financial goals.

Set Spending Limits

Based on your analysis, set realistic limits for each category. This will keep you on track and prevent overspending. Remember, the limits should be flexible and adapted to changing financial situations.

Regular Review And Adjustment

Make it a habit to review your categorized expenses regularly—every month or quarter. This will keep you accountable and allow you to make adjustments as needed. Be prepared to revise your categories and spending limits as your financial goals or circumstances change.

Keeping a Balanced Budget Through Expense Tracking

Expense tracking is the foundation of a balanced budget. Regularly tracking your spending habits will show you precisely where your money is going and how to spend it more effectively.

The Power Of Knowledge

By tracking expenses, you become aware of your financial patterns. With this heightened awareness comes the tendency to make more conscious spending decisions. You will think twice about making those impulsive purchases or discover that those small daily expenses can add up.

Identifying Areas To Improve

Expense tracking reveals where you might be spending too much. You may be spending more dining out than you realized, or those subscription services add up to more than you thought. This information will let you make educated decisions about where to scale back.

Adapting To Financial Changes

Life is full of financial ups and downs. By consistently tracking your expenses, you can quickly adapt your budget to accommodate changes in income or unexpected costs. This flexibility is crucial for maintaining financial stability in the long run.

Mastering Your Financial Future

You can take control of your financial life by applying good practices of expense tracking with the help of appropriate tools. Choose a system that will fit your needs and lifestyle, whether a simple spreadsheet or an all-inclusive app. Regularly review your spending habits and set realistic budgets that you can constantly adjust. You will get insights from your financial patterns by consistently tracking and analyzing them; thus, you make informed decisions.